Heymondo Travel Insurance

The Best for Stress-Free Adventures

Hey, if you’re someone who loves adventure like hiking, diving, or exploring new cities, you get the excitement of exploring the unknown. But let’s talk about the reality – sometimes things don’t go as planned, and that’s where Heymondo Travel Insurance comes into play. Imagine you’re on a thrilling adventure when something unexpected happens – maybe your camera disappears in a bustling market or you receive urgent news about a family member back home.

Now, you might be wondering – do I really need travel insurance? It’s a fair question, especially when you’re filled with excitement. But think about it: what if something unexpected happens? A medical emergency in a foreign country, an injury during an adventure activity, or having to cancel your trip unexpectedly. Could you handle it all on your own?

That’s where travel insurance comes in. It’s your safety net, your backup plan for when things go wrong. With comprehensive coverage from Heymondo, you can travel with peace of mind, knowing you’re protected against unexpected mishaps.

Medical coverage? Check. Emergency assistance? Absolutely. Trip cancellation and interruption? Covered. And don’t forget baggage protection – because losing your belongings shouldn’t spoil your trip.

So, before you embark on your next adventure, consider the value of travel insurance. It could make all the difference in turning a potential disaster into just a minor hiccup.

Table of Contents

Who is Heymondo?

Heymondo, owned by Smart Insurance Correduría de Seguros S.L. and based in Barcelona, Spain, is a well-regarded travel insurance company. Since starting under the Mondo brand in 2016, Heymondo has provided coverage to over a million travelers in more than 150 countries.

They have received positive feedback on Trustpilot, with ratings typically between 4.3 and 4.5 out of 5, highlighting their commitment to customer satisfaction. Heymondo collaborates with notable travel blogs such as Travel of Path, Capture the Atlas, Salt in Our Hair, Journey Era, The World Pursuit, and The Broke Backpacker.

For their English-speaking customers, Heymondo partners with AXA Insurance and Iris Global. Their services are available worldwide, ensuring travelers have access to reliable coverage wherever they go.

Is Travel Insurance Worth It?

When considering if travel insurance is worth it, think of it as a crucial safety net for your adventures. Much like how you wouldn’t hit the road without car insurance, travel insurance acts as a financial backup plan for unexpected events while you’re exploring the world.

Take my experience in Bolivia, navigating the Uyuni Salt Flats during my 2018 world trip. Altitude sickness struck, leading to a three-day hospital stay and a hefty $500 bill. Thankfully, my travel insurance covered the costs, proving its worth in unexpected situations.

On a recent trip I guided in Peru, almost half my group got sick, likely from altitude sickness, something they ate, dengue, or a combination of factors. Several people had to see a doctor or call one to the hotel. With travel insurance, all of that was covered, including potential hospital stays and medical tests.

Last summer, my parents faced a challenging situation in Corsica with hospital stays and surgery. While credit cards helped with some costs, the potential €50,000 bill for a medical helicopter back to Portugal underscored the importance of having travel insurance.

Consider my friend in Colombia who dealt with appendicitis in a remote village. His travel insurance covered the entire medical journey, including an upgraded business class ride back to Austria for him and his girlfriend. Without insurance, the financial implications could have been daunting.

In conclusion, travel insurance is absolutely worth it, serving as an essential backup plan for unforeseen circumstances during your adventures.

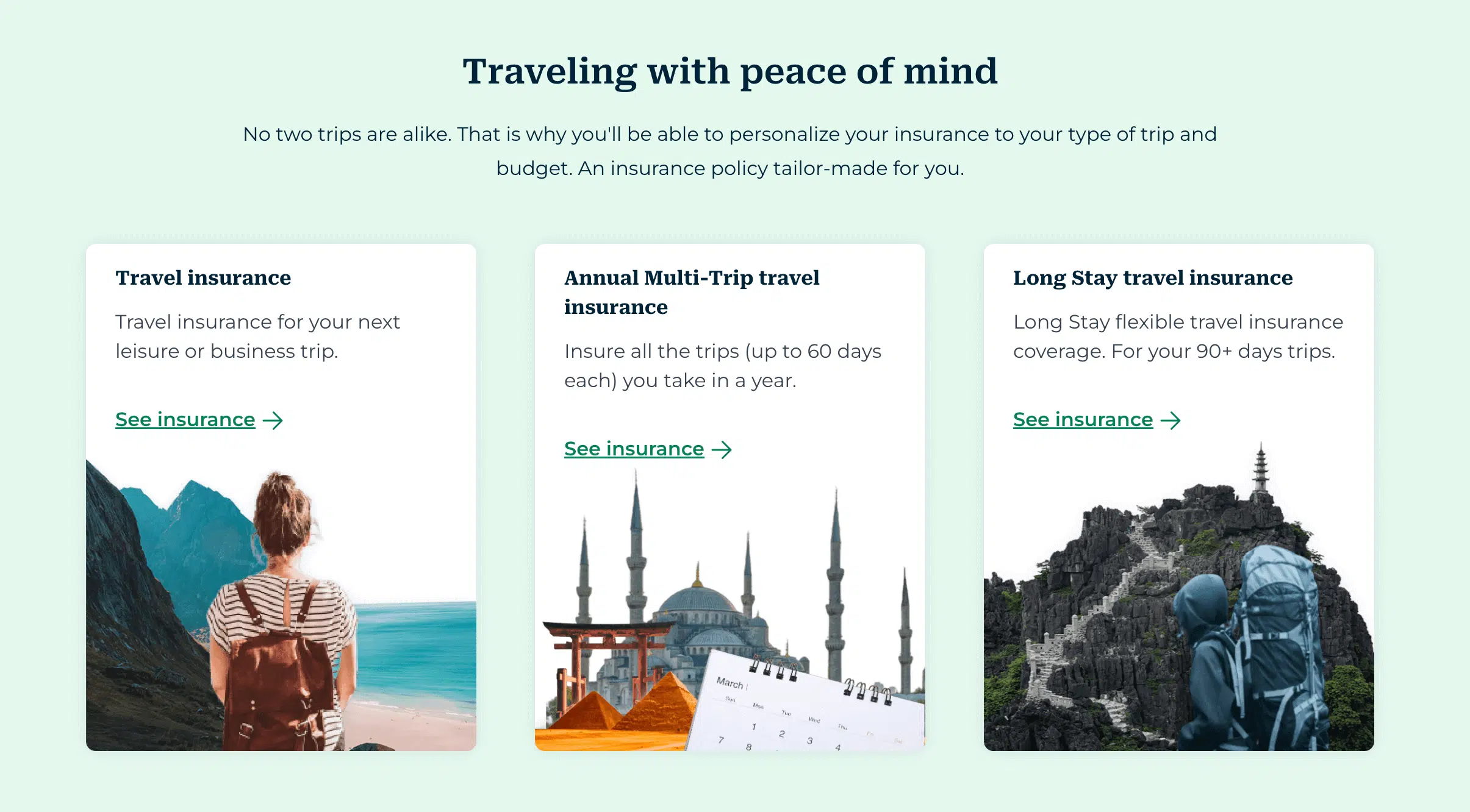

What types of travel insurance does Heymondo provide?

Heymondo offers three types of travel insurance:

- Travel Insurance: This is the most comprehensive option, suitable for both international and domestic trips. You can customize the coverage to meet your needs by adding extra protection or adjusting coverage limits. All plans are perfect for solo travelers, those traveling with friends, or family trips.

- Annual Multi-Trip Travel Insurance: Ideal for frequent travelers, this insurance covers all your trips throughout the year, with each trip not exceeding 60 days. It’s suitable for both leisure and business travel. If planning a stay longer than 60 days, consider the Long Stay insurance.

- Long Stay Travel Insurance: This insurance is designed for extended trips, with a minimum purchase of 90 days. You can buy it even after your trip has started and renew it as needed, with the renewal price shown in advance. It offers flexible renewal options directly from your online account.

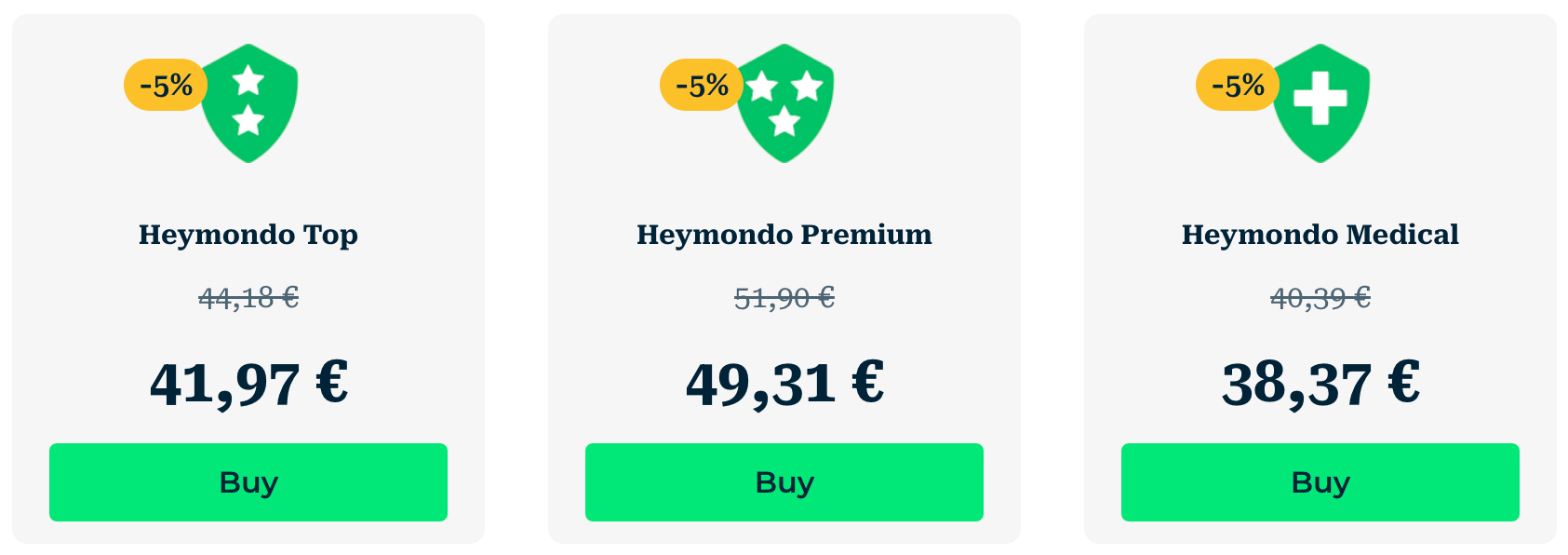

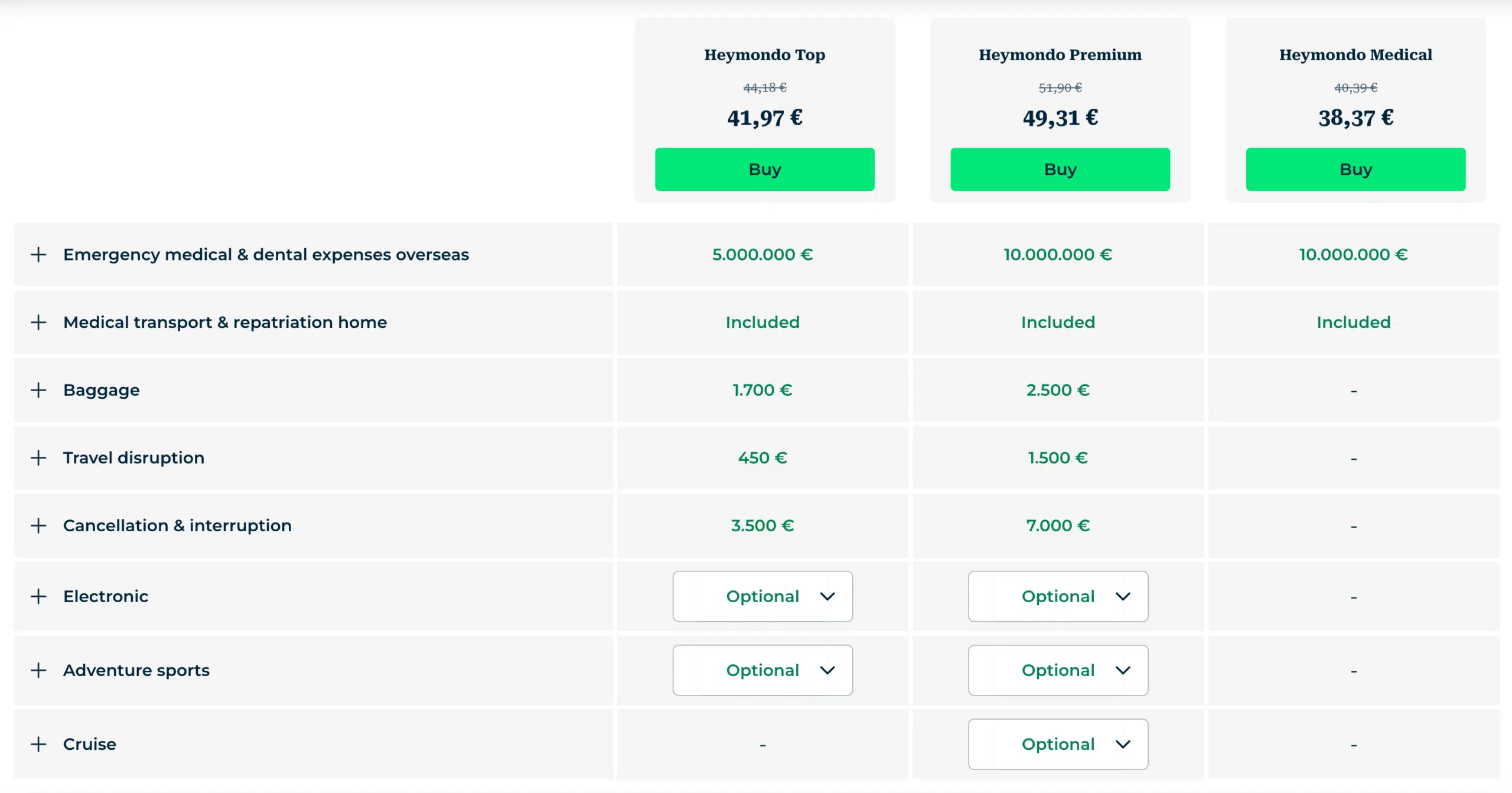

What's Included in the Heymondo Travel Insurance?

- Medical Expenses: Coverage up to $10,000,000 USD for medical expenses abroad due to sudden illness or accidental injury.

- Repatriation and Early Return: Up to $500,000 USD for repatriation and early return expenses.

- Luggage Theft and Damage: Coverage up to $2,500 USD for theft or damage to luggage.

- Trip Cancellation: Up to $7,000 USD for trip cancellation due to covered reasons.

2. Annual Multi-Trip Travel Insurance:

- Medical Expenses: Same as the standard travel insurance, up to $10,000,000 USD.

- Repatriation and Early Return: Up to $500,000 USD.

- Luggage Theft and Damage: Coverage up to $2,500 USD.

- Trip Cancellation: Up to $7,000 USD.

3. Long Stay Travel Insurance:

- Medical Expenses: Coverage up to $2,500,000 USD for medical expenses abroad.

- Repatriation and Early Return: Up to $500,000 USD.

- Luggage Theft and Damage: Coverage up to $1,200 USD.

- Trip Cancellation: Not explicitly mentioned.

Each plan also includes additional coverages such as emergency medical and dental expenses overseas, extended lodging expenses due to illness or medical quarantine, outpatient physiotherapy treatment, travel expenses for a family member, lodging expenses for a family member, medical transportation and repatriation home, baggage coverage, cancellation & interruption coverage, travel disruption coverage, and optional coverages like electronic equipment coverage and adventure sports coverage.

Annual Multi-Trip Travel Insurance and Long Stay Travel Insurance have specific excess/deductible amounts for medical expenses coverage, and they both offer additional assistance coverages like search and rescue, coverage for natural disasters, personal liability, accidental death or disability, and rental car excess coverage.

For a comprehensive overview of their insurance offerings, please visit their official website.

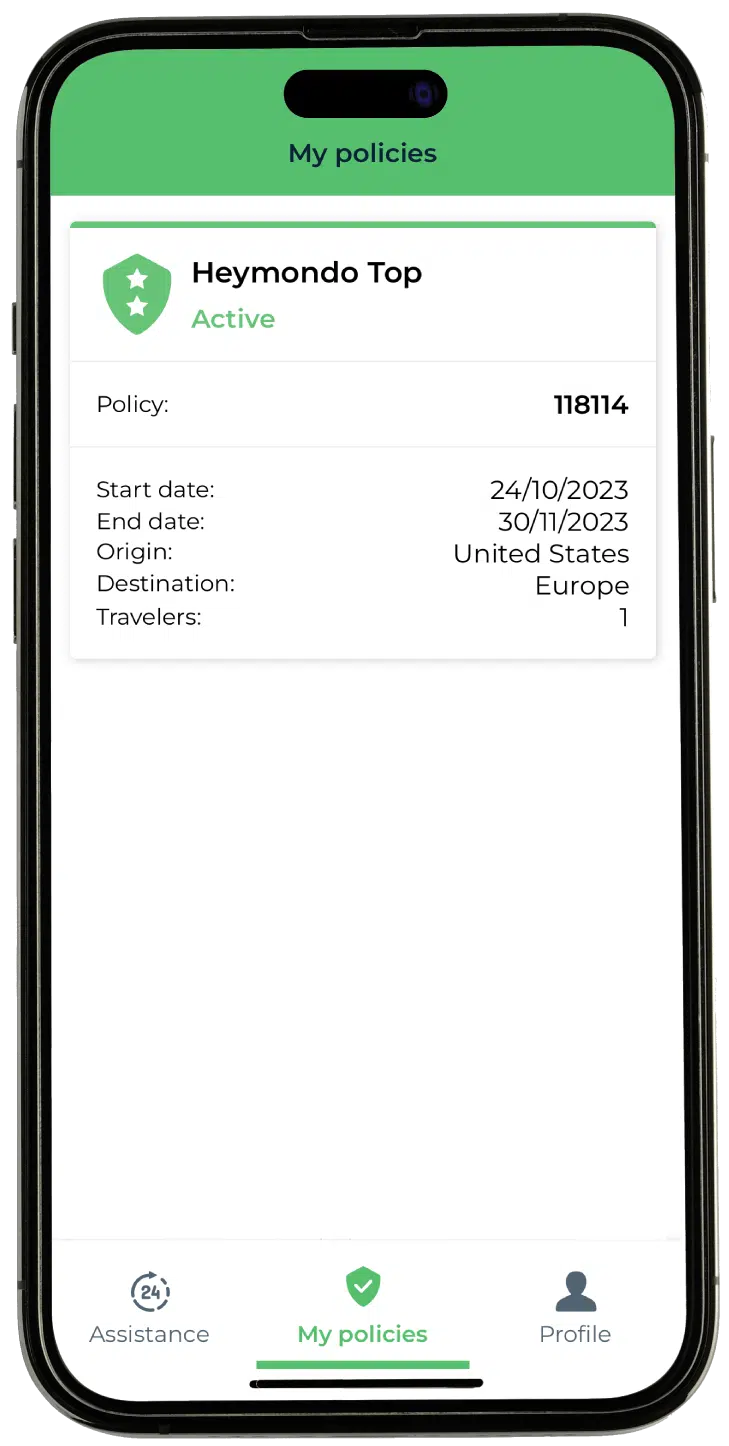

Heymondo Travel Assistance App

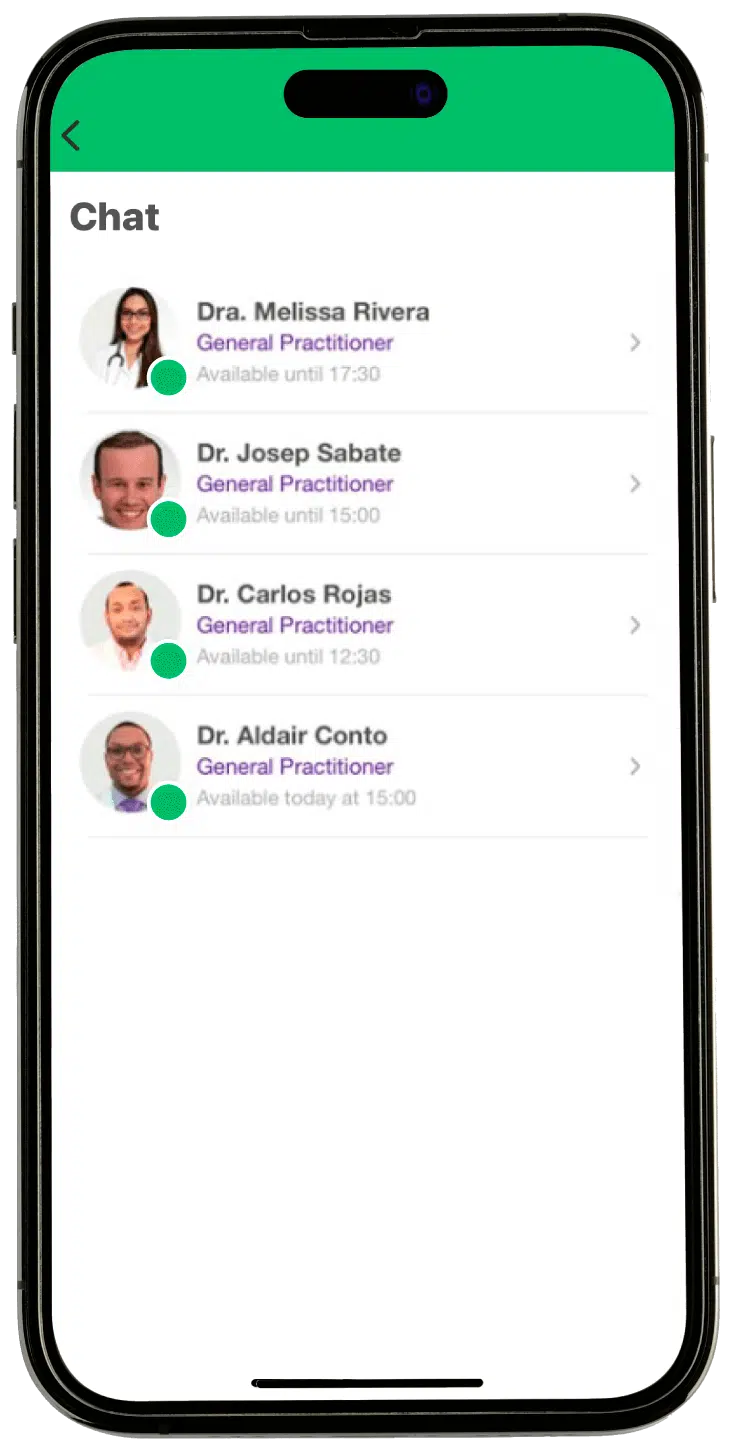

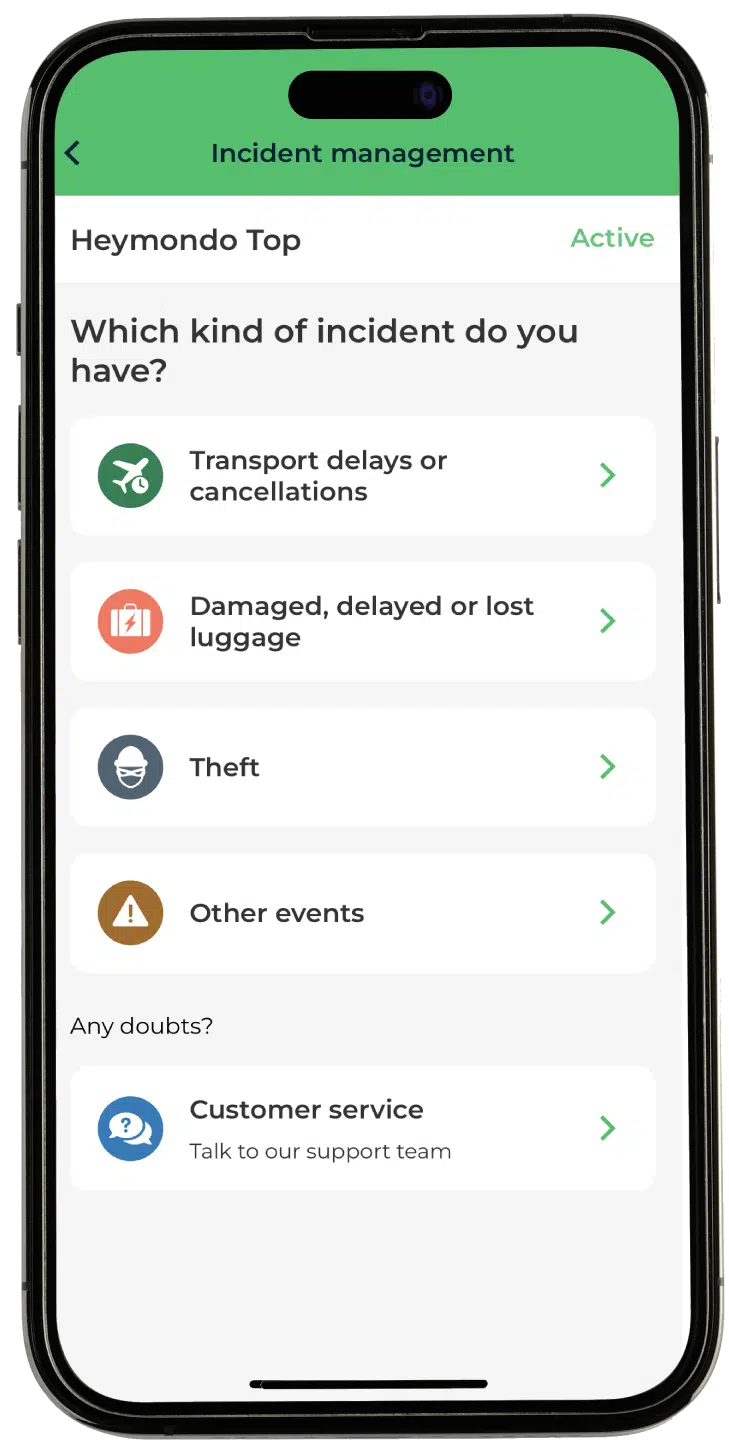

24/7 Medical Chat, Free Assistance Calls, and more...

- 24/7 medical chat and free online assistance calls for immediate professional advice and emergency aid worldwide.

- Efficient incident reporting for quick resolution processes.

- Access to essential policy details, including policy numbers, certificates, and contacts, making it easy to handle issues like transport delays or damaged luggage.

Conclusion: Is Heymondo Worth it?

In summary, Heymondo offers travelers competitive prices, excellent customer service, and broad coverage tailored to various destinations.

With no out-of-pocket medical expenses and a user-friendly app for streamlined assistance, Heymondo ensures travelers are supported around the clock. The ability to customize coverage, purchase post-departure, and receive a full refund within a month of purchase further enhances its value proposition, making Heymondo a standout option for comprehensive travel insurance.

As an affiliate of Heymondo, I’ve luckily never needed to use their insurance in any misfortune. However, all my biggest references of bloggers have used them for years and always had great experiences. The Trustpilot reviews speak for themselves. Personally, what makes me choose to partner with Heymondo is its amazing convenience. This includes the 24/7 doctor chat in the app, no out-of-pocket payment when entering a hospital (if reported to Heymondo before entering), and additional coverage for electronics and adventure sports.

That said, I always recommend visiting their website to check all the details and comparing them with other insurance options to find the best fit for your needs.

Plan your next adventure with us!

Here are the links we use and recommend to plan your trip easily and safely. You won’t pay more, and you’ll help keep the blog running!

Adventures in Sri Lanka - The Ancient Ceylon

Explore The Galapagos Islands

Hiking in Switzerland & Italy

The Hidden Worlds of Ecuador

ABOUT ME

I’m João Petersen, an explorer at heart, travel leader, and the creator of The Portuguese Traveler. Adventure tourism has always been my passion, and my goal is to turn my blog into a go-to resource for outdoor enthusiasts. Over the past few years, I’ve dedicated myself to exploring remote destinations, breathtaking landscapes, and fascinating cultures, sharing my experiences through a mix of storytelling and photography.

SUBSCRIBE

Don’t Miss Out! Be the first to know when I share new adventures—sign up for The Portuguese Traveler newsletter!

MEMBER OF

RECENT POSTS

COMMUNITY

TRAVEL INSURANCE

Lost luggage, missed flights, or medical emergencies – can you afford the risk? For peace of mind, I always trust Heymondo Travel Insurance.

Get 5% off your insurance with my link.