Home > Travel Tips > SafetyWing Nomad Insurance 2.0 – Travel Medical Insurance

SafetyWing Nomad Insurance 2.0

Travel Medical Insurance - Because Misadventures Happen.

- Last Updated: November 15, 2023

If you’re checking this out, chances are you’re into hiking, scuba-diving, climbing, and all things adventure and nature. But here’s the thing – when you’re out there in a new place, doing your thing, the big question hits: Do I need travel medical insurance? I mean, what if something goes south? Are you really just going to cross your fingers and hope for the best, thinking you’re invincible around the clock?

Consider the scenario of a potential monkey bite in Bali, finding yourself in a motorbike accident, dealing with the theft of your expensive camera while exploring a beautiful city, or facing the need to return home due to the tragic passing away of a family member. In the midst of these unforeseen situations, do you have the financial means to navigate through them while abroad?

Wouldn’t it be much easier just to activate your travel medical insurance that covers all of these misadventures and relax about it and enjoy your trip?

To help you figure out if Travel Medical Insurance is your thing, I’ve got the details of the most important question in the next paragraphs.

Table of Contents

Who Is SafetyWing?

SafetyWing, is a Norwegian company founded in 2017 in Silicon Valley, California, specializes in services tailored for digital nomads and remote workers. Their flagship product is Nomad Insurance, an International Travel Medical Insurance with a recently launched version 2.0. They also offer Nomad Health, providing health insurance globally, Remote Health for remote companies seeking employee health coverage, and have plans for Remote Doctor and Remote Retirement in the future.

Beyond insurance, SafetyWing fosters a strong community with resources like free courses and expert talks to support remote workers. They envision themselves as “your home country on the internet,” aiming to eliminate geographical barriers for equal opportunities. SafetyWing is building a global social safety net, dedicated to creating an adaptable software-based safety net for people worldwide.

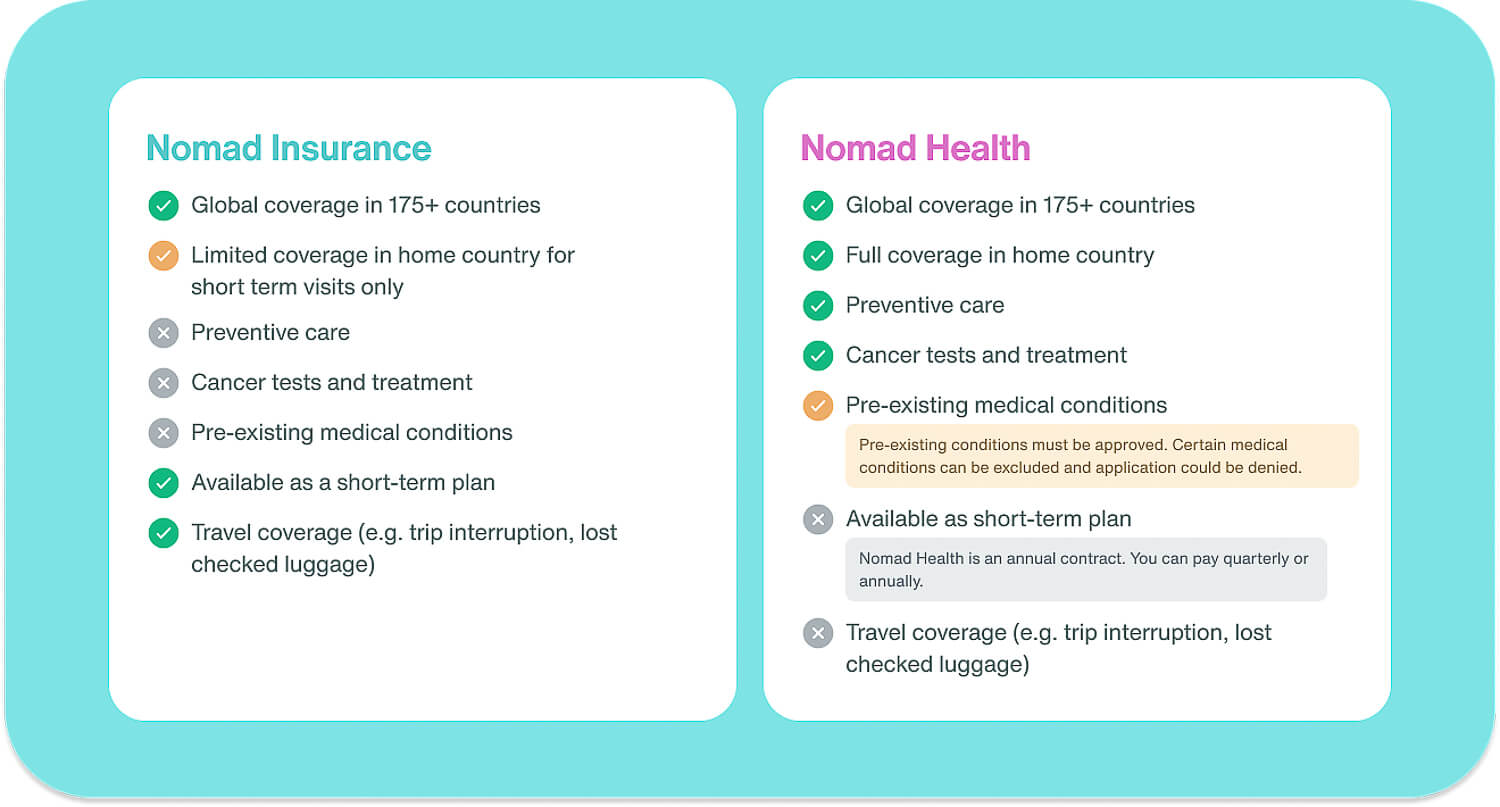

Travel Medical Insurance Vs. Health Insurance

In summary, Nomad Insurance, SafetyWing’s Travel Medical Insurance plan is focused on emergency medical coverage during international travel, while Nomad Health, their Health Insurance plan provides a more extensive health insurance package for individuals living a nomadic or remote lifestyle. The choice between the two depends on the level of coverage and benefits an individual requires based on their lifestyle and health needs.

Is Travel Medical Insurance Worth It?

When considering if Travel Medical Insurance is worth it, think of it as a crucial safety net for your adventures. Much like how you wouldn’t hit the road without car insurance, travel insurance acts as a financial backup plan for unexpected events while you’re exploring the world.

Take my experience in Bolivia, navigating the Uyuni Salt Flats in my 2018 World Trip. Altitude sickness struck, leading to a three-day hospital stay and a hefty $500 bill. Thankfully, my travel insurance covered the costs, proving its worth in unexpected situations.

My parents faced a challenging situation in Corsica last summer, with hospital stays and surgery. While credit cards helped with some costs, the potential €50,000 bill for a medical helicopter back to Portugal emphasized the importance of having travel insurance.

Consider my friend in Colombia, dealing with appendicitis in a remote village. His travel insurance covered the entire medical journey, including an upgraded business class ride back to Austria for him and his girlfriend. Without insurance, the financial implications could have been daunting.

In conclusion, I can’t stress enough how Travel Medical Insurance is 200% worth it, serving as an amazing backup plan for unforeseen circumstances during your adventures, much like car and home insurance in their respective domains.

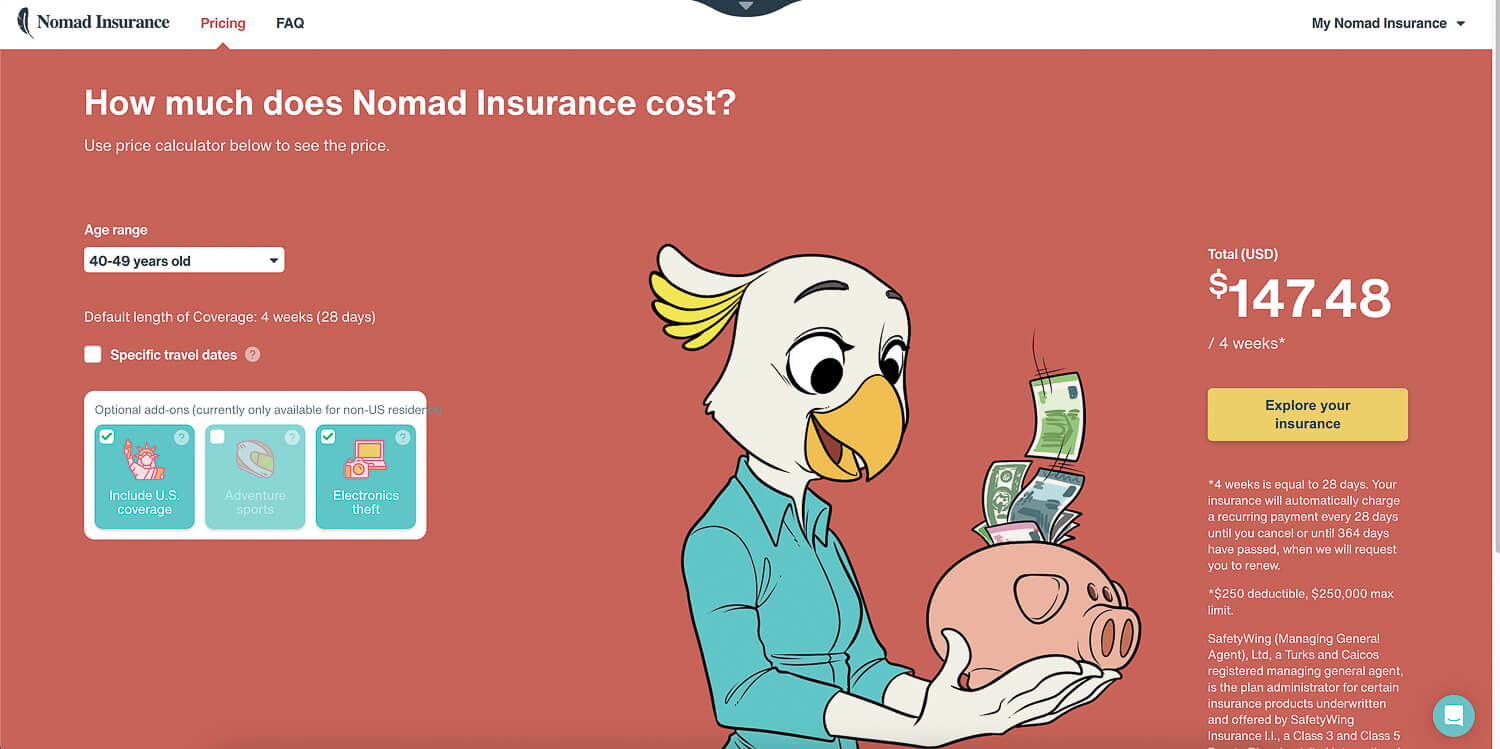

With SafetyWing, you can have peace of mind for four weeks for only $45.08 (if you’re between 18-39 years old).

What's Included in SafetyWing's Nomad Insurance

Medical Coverage:

- Covers accidents or illnesses requiring medical assistance while outside your home country: Max Limit: $250,000 ($100,000 for WorldTrips policy holders over 65).

- Deductible: $250.

- Includes medically necessary treatment of unexpected illnesses or injuries (inpatient or outpatient).

- Ambulance and emergency transportation: Covered up to the max policy limit when the covered illness or injury results in hospitalization.

- Emergency transportation to a better-equipped hospital (medical evacuation): Up to $100,000 lifetime max, or up to $25,000 for pre-existing conditions.

- Emergency dental treatment: Covered up to $1,000 for the acute onset of pain if treated within 24 hours.

- All other benefits covered up to the overall max limit.

Notable exclusions include high-risk sports activities, pre-existing diseases or injuries, and cancer treatment. (To cover high-risk sports activities, you have now the option to purchase an additional “Adventure Sports” Add-On.)

Travel Coverage:

- Covers travel-related issues such as: Delay, lost luggage, emergency response, natural disasters, and personal liability.

- Trip interruption (due to an unforeseen event in your home country): Up to $5,000.

- Unplanned overnight stay: Up to $100 per day for up to 2 days.

- Lost checked luggage: Up to $3,000 per active insurance period, $500 per item, with a $6,000 lifetime max.

- Accommodation in a different place due to a natural disaster causing evacuation: Up to $100 a day for up to 5 days.

- Evacuation from local political unrest: Up to $10,000 lifetime max.

- Personal liability: Up to $25,000 lifetime max for third-person injury or property, and up to $2,500 for related third-person property.

- Coverage for arrangements for your body (burial or repatriation of remains): Up to $20,000 for transportation or up to $10,000 for local burial.

- Cash payout to your beneficiary (accidental death): Up to $25,000, with the death being the sole and direct result of bodily injury caused by external, violent, and visible means.

Click here for the entire Nomad Insurance’s Policy.

Nomad Insurance 2.0

Adventure Sports & Electronics Theft Coverage

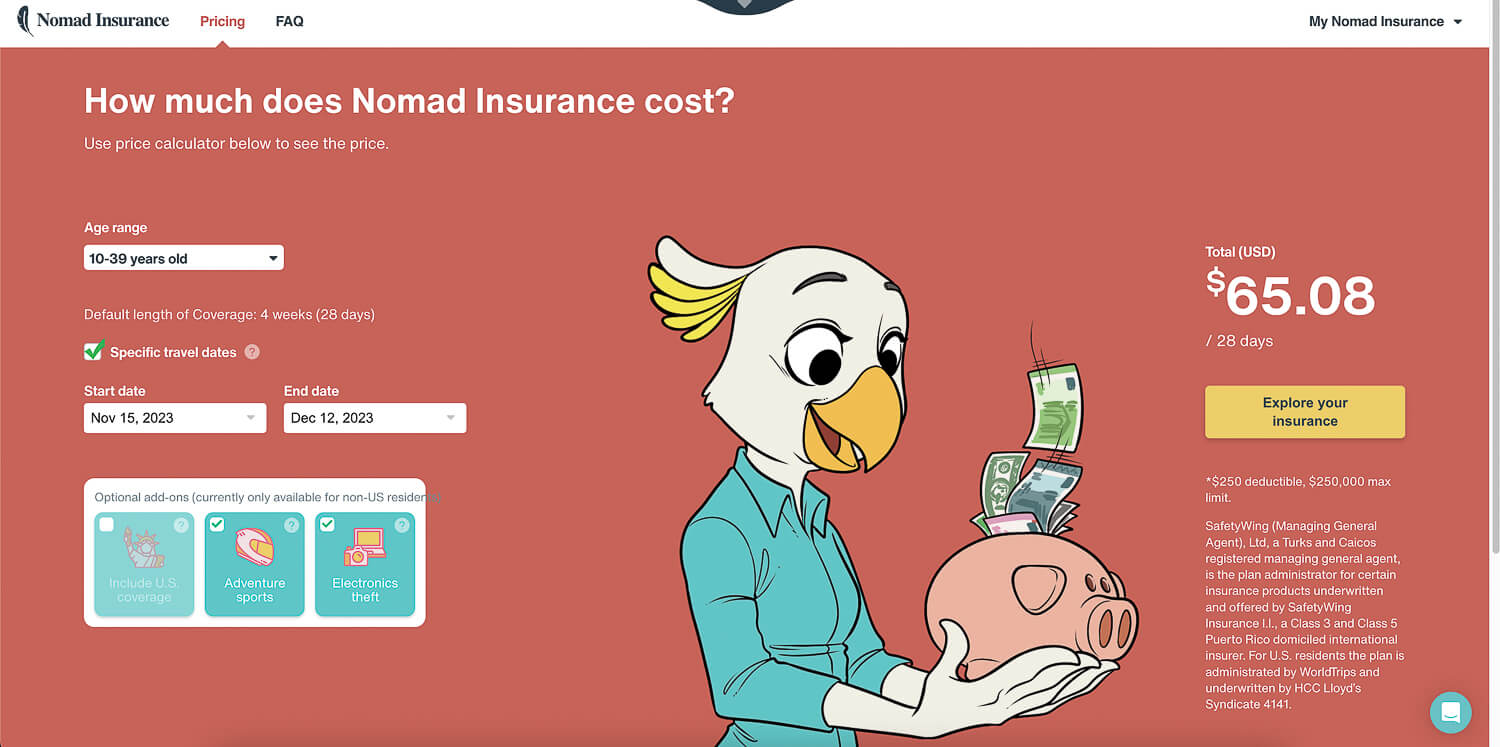

If what they cover falls short, consider their new add-ons for Adventure Sports and Electronics Theft Coverage. These are the two most useful features for me in their insurance, given my regular engagement in activities such as hiking and mountaineering at altitudes over 4500m, as well as scuba diving—usually not covered in standard travel insurances. Additionally, I always carry a significant amount of electronic gear, and the potential cost of theft could be substantial.

The outstanding feature of the Electronics Theft coverage is that it provides up to $1000 per item, a significant improvement compared to the usual $500 limit in other travel insurances. Given that my lenses alone cost around $800 and my cameras and computer far exceed that value, the maximum coverage offered by an insurance policy is a crucial consideration for me.

In this latest update, they’ve introduced an impressive array of Adventure Sports that should suffice for the majority of adventurers. The extended Electronics Theft coverage is a significant enhancement that adds to my excitement about what they might introduce next.

If you’re interested in exploring all the new features, you can check all the new details here: Electronics Theft Coverage.

Here’s the list of all the new adventure sports they cover:

- American football

- Aussie rules football

- Aviation

- Bobsleigh

- Boxing

- Cave diving

- Free-style skiing

- Hang gliding

- High diving

- Ice hockey

- Karting

- Kite-surfing

- Martial arts

- Luge

- Motorbiking

- Motorized dirt bikes

- Mountaineering at elevations under 6000 meters altitude

- Parachuting

- Parasailing

- Paragliding

- Quad biking

- Rugby

- Ski / snowboard jumping

- Ski-flying

- Skiing / snowboard acrobatics

- Skydiving

- Skeleton

- Snow mobile

- Spelunking

- Scuba diving accompanied by an instructor certified by PADI/NAUI/SSI/BSAC

- Tandem skydiving

- Tobogganing

- Whitewater rafting

- Wrestling